Inflation has been the primary economic talking point since the pandemic. The past few years have seen governments scramble to find their version of a quick solution, but the matter has dragged on as slow and steady improvement takes place.

On a governmental level, tackling inflation is a complex, exhaustive task. However, on an individual investor's level, there are solutions that can help alleviate the issue and allow them to maintain - and even grow - their wealth in times of economic strain.

Savvy investments can aid investors in mitigating the effects of inflation, and in a world full of new digital assets and traditional tangible ones, the real estate asset class remains the ultimate hedge against inflation.

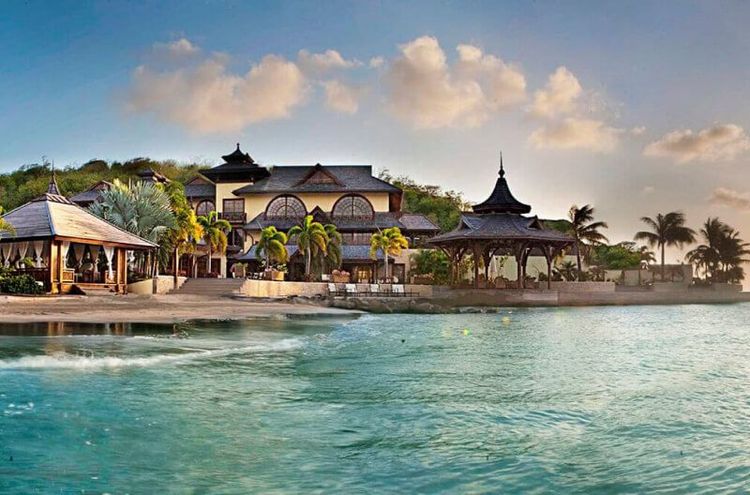

One of the best strategies in times like this is to diversify a real estate portfolio to encompass properties in different locations. In this piece, using statistics from varied, specialized sources, we will cover some of the most interesting countries that offer real estate markets with compelling potential profitability and property-based residency by investment programs, giving another dimension to the venture.

UAE

The UAE is home to one of the world's most dynamic housing markets. The growth in demand has been astonishing in the past few years, culminating with a residential property price index (RPPI) growth rate of 20.14% y-o-y (16.34% inflation-adjusted) in 2023.

This growth comes on the back of continuous improvement in the previous years, as the UAE's RPPI registered increases of 9.53% and 9.25% in 2022 and 2021, respectively.

This growth comes on the back of continuous improvement in the previous years, as the UAE's RPPI registered increases of 9.53% and 9.25% in 2022 and 2021, respectively.

Dubai, unsurprisingly, has been the Emirate with the most significant average house price increase, as average apartment prices grew 19.83% in 2023, while villas saw their prices soar 21.76% in the same year.

As a hedge against inflation goes, the UAE offers a robust solution. Average inflation rates during 2023 in the UAE were a mere 3.12%, just 15%, the rate of the average apartment price growth rate in Dubai. But it isn't only about capital gains.

The average rental ROI in Dubai in 2023 was 6.3%, nearly double the inflation rate, with ROI ranging from 6% to 9% throughout the city. This means investors could easily beat inflation losses and make a profit through rent alone. Combining that with the capital gains potential, and the UAE offers investors an excellent option.

However, there are some concerns regarding Dubai’s current housing markets. Some experts feel that the rapid increase in pricing and unrelenting demand, combined with the high leverage loans banks offer, may create a bubble like the one that popped in 2009. This is a rational thesis, but looking at how the Dubai government adapted to the crisis 15 years ago may allude to a better operational framework this time around. This does remain a factor to consider, especially with other interesting options in the country.

The country’s capital, Abu Dhabi, is another excellent option. According to some sources, apartment prices in the capital grew by an average of 4.2%, while villa prices grew by 5.7% annually. Rental returns are also impressive, with Al Reem Island being particularly interesting as average rental ROI rates ranged between 6.33% and 8.32% Saadyiat Island wasn’t the best option in the past year, with the highest rental average being 4.25%, but other areas such as Al Raha Beach and Yas Island provided impressive returns ranging from 5.45% to 6.45% and 5.8% and 7.11%, respectively..

Ras Al Khaimah (RAK) is another interesting option, with rental ROI ranging between 2.77% and 6.07% in Al Marjan Island and Al Hamra Village. According to some experts, property prices in RAK grew an astonishing 50% in 2023, and are posed to grow an additional 50% once the much anticipated Wynn Resort opens, driving up demand and creating a more touristic environment in the city.

The UAE also has a Golden Visa program, under which investors can obtain a 10-year residency permit when investing AED 2 million (approximately US$545,000) in real estate. New regulations make the Golden Visa more attractive as investors only need to invest half the sum upfront to acquire residency and have five years to complete the total amount.

Turkey

Turkey, in general, and Istanbul, in particular, have always been a magnet for real estate investors. The market is so attractive that in 2023, property prices registered a staggering growth rate of 86.46%.

Supply had barely been keeping up with demand in the past few years, but due to hyperinflation, reaching an unattainable rate of 64.8%, the Turkish government has begun taking drastic measures to curb inflation.

Turkish President Recep Tayyip Erdoğan instated financial wizard Mehmet Şimşek as Minister of Finance, and the effects are already being felt.

Turkish President Recep Tayyip Erdoğan instated financial wizard Mehmet Şimşek as Minister of Finance, and the effects are already being felt.

Şimşek is a traditionalist, and his first move was to raise interest rates, which in turn lowered the overall demand for real estate. In 2023, the number of home sales in Turkey declined by 14.9%, and experts expect this trend to continue as the government tackles rampant inflation.

This opens a unique opportunity for investors. As demand slows, the massive supply will lead to declining real estate prices. It is simple economics at the end of the day, and investors can swoop in to bag a bargain before the government stabilizes the inflation rate and the market booms once more.

There is massive potential for gains in one of the globe's most attractive real estate markets. Even as investors wait for higher appreciation rates to kick in, rental ROI in Turkey is no slouch, registering an average of 6.79% in Istanbul. While that rate can't compete with inflation in Turkey, it is much higher than inflation rates in various other countries and matches the world average of 6.8%.

Turkey also has the benefit of offering real estate investors who acquire property for at least US$400,000 naturalization through its citizenship by investment program. However, Turkey’s program may complicate the issue of real estate, as many properties listed for $400,000 are priced as such for the sake of the program, and in reality their true value may be less.

The Turkish government does assign independent evaluators to evaluate the property, but that process can be done before or after purchase, so doing it before committing to an acquisition is crucial.

For investors that want to obtain the Turkish citizenship through a solid investment, maybe pursuing one or more properties with a total that exceeds the $400,000 mark may be better, as the properties won’t be marked up for the sake of citizenship as their value already exceeds the minimum requirement.

Spain

Spain offers a more balanced housing market for investors who prefer a more conservative approach. Average property prices grew 7.3% in 2023, while rental ROI stood at a respectable 5.3% in Madrid and 6.27% in Barcelona.

Property prices in Madrid rose 7.6%, while Catalonia saw prices surge 8.1%. However, both were beat by Andalucia (8.3%), Balears (8.3%), and Cantabria, which registered a high average of 9.3%.

Going into the intericate pricing of the Spanish market is essential to understand what areas offer stellar property investments. For example, while Andalucia did register a remarkable growth rate, a closer look at one of its most popular cities, Marbella, highlights the opportunities available.

Property prices in Madrid rose 7.6%, while Catalonia saw prices surge 8.1%. However, both were beat by Andalucia (8.3%), Balears (8.3%), and Cantabria, which registered a high average of 9.3%.

Going into the intericate pricing of the Spanish market is essential to understand what areas offer stellar property investments. For example, while Andalucia did register a remarkable growth rate, a closer look at one of its most popular cities, Marbella, highlights the opportunities available.

According to local sources, property prices in Marbella grew an impressive 15% in 2023, nearly double of that in Madrid, emphasizing the need to consider all aspects when looking to acquire a property in the country.

However, those who look at the finer details can spot an opportunity on the horizon. While demand for housing continues to grow (Spain registered a 14.7% increase in home sales in 2022), the supply is slowing down as new residential construction fell by 20.5% in the same year. If this trend continues, we can witness a massive growth in prices due to the imbalance between supply and demand.

Another interesting opportunity is land. The average price per square meter of land in Madrid fell by a massive 22.4% in 2022, and in Cataluna, it went down by 3.3% during the same year. Investors who want to set themselves up for potentially massive gains can choose to invest in land while prices are low.

Considering that both residential real estate and land qualify for Spain's Golden Visa, which requires an investment of at least €500,000 in immovable property, Spain offers a unique investment environment. The only issue is that some parties in the Spanish Parliament are pushing for the closure of the program, so quick action is needed from investors who want to apply for a Spanish Golden Visa.

Greece

Greece’s red-hot property market remains an attractive prospect for investors looking to hedge against inflation by making an investment that has high potential ROI in the shape of rent and capital gains.

Athens, Greece’s main real estate FDI magnet, has an outstanding housing market that saw real estate prices soar 14% in 2023. But the capital isn’t the only major city that boasts a dynamic property market, as home prices in Thessaloniki averaged a growth of 16.37% in the same year.

Athens, Greece’s main real estate FDI magnet, has an outstanding housing market that saw real estate prices soar 14% in 2023. But the capital isn’t the only major city that boasts a dynamic property market, as home prices in Thessaloniki averaged a growth of 16.37% in the same year.

The beauty of Greece’s housing market is its variety, as different areas offer different profit rates. For instance, although home prices in Thessaloniki grew higher than Athens the past year, the average rental ROI in the capital was significantly higher, averaging 5.25% compared to Thessaloniki’s 4.38%. Investors can find the property that matches their goals and preferences.

Greece also boasts an exciting Golden Visa program, which has a real estate option starting at €250,000, making it one of the best real estate investment destinations, especially for those looking to combine solid investments with a robust global mobility asset.

Hungary

Hungary offers a different investment opportunity for investors. The EU country is currently facing inflation issues as well but is taking drastic measures to tackle them, and those measures are having an impact on the housing market.

After years of consistently high growth, Hungary's real estate market, as the average home price increase of 2.82% for the first quarter of 2023, is a far cry from the 10.56% increase in Q1 2023, 17.19% in Q4 2022, and 24.12% in Q3 2022 that predated it.

After years of consistently high growth, Hungary's real estate market, as the average home price increase of 2.82% for the first quarter of 2023, is a far cry from the 10.56% increase in Q1 2023, 17.19% in Q4 2022, and 24.12% in Q3 2022 that predated it.

This means that property prices are still growing but are doing so at a slower pace. Those familiar with the housing market cycle in Hungary can see the opportunity on offer.

The last time Hungary drastically raised interest rates was in 2009 as a response to the financial crisis. Housing prices dropped for a couple of years before suddenly skyrocketing a few years later. The same trend can be expected here.

Hungary also offers investors residency through a €500,000 real estate investment under its Guest Investor Visa program, which awards successful applicants with a 10-year, renewable residency permit.

Global mobility is the ultimate hedge

While real estate investment assets are an excellent hedge against inflation, the optimal ones are global mobility assets such as second citizenships or residency permits.

By removing one country's monopolization over a person's interest, investors can truly function on a global scale and manage their wealth and assets in the way they see best, mitigating economic and political risks.

Luckily, the current real estate-based investment migration programs provide investors with both opportunities; a solid investment asset that brings with it a global mobility asset.

Combining real estate investments with global mobility assets is the ultimate risk mitigation practice. Unlike investing in stocks, currency, or virtual assets, for example, real estate carries with it very little risk. Property appreciation continues to grow, even in times of economic strain, unlike stocks which are more fickle and are prone to losses as well as profits.

Property investments are safe, stable, and resilient. For risk mitigation, real estate is the best asset class, and combining it with investment migration produces a robust hedge against economic and political instability.

To know more about hedging against inflation through investment migration, contact One World today to book a comprehensive consultation with one of our experts.

This growth comes on the back of continuous improvement in the previous years, as the UAE's RPPI registered increases of 9.53% and 9.25% in 2022 and 2021, respectively.

This growth comes on the back of continuous improvement in the previous years, as the UAE's RPPI registered increases of 9.53% and 9.25% in 2022 and 2021, respectively. Turkish President Recep Tayyip Erdoğan instated financial wizard Mehmet Şimşek as Minister of Finance, and the effects are already being felt.

Turkish President Recep Tayyip Erdoğan instated financial wizard Mehmet Şimşek as Minister of Finance, and the effects are already being felt. Property prices in Madrid rose 7.6%, while Catalonia saw prices surge 8.1%. However, both were beat by Andalucia (8.3%), Balears (8.3%), and Cantabria, which registered a high average of 9.3%.

Going into the intericate pricing of the Spanish market is essential to understand what areas offer stellar property investments. For example, while Andalucia did register a remarkable growth rate, a closer look at one of its most popular cities, Marbella, highlights the opportunities available.

Property prices in Madrid rose 7.6%, while Catalonia saw prices surge 8.1%. However, both were beat by Andalucia (8.3%), Balears (8.3%), and Cantabria, which registered a high average of 9.3%.

Going into the intericate pricing of the Spanish market is essential to understand what areas offer stellar property investments. For example, while Andalucia did register a remarkable growth rate, a closer look at one of its most popular cities, Marbella, highlights the opportunities available. Athens, Greece’s main real estate FDI magnet, has an outstanding housing market that saw real estate prices soar 14% in 2023. But the capital isn’t the only major city that boasts a dynamic property market, as home prices in Thessaloniki averaged a growth of 16.37% in the same year.

Athens, Greece’s main real estate FDI magnet, has an outstanding housing market that saw real estate prices soar 14% in 2023. But the capital isn’t the only major city that boasts a dynamic property market, as home prices in Thessaloniki averaged a growth of 16.37% in the same year. After years of consistently high growth, Hungary's real estate market, as the average home price increase of 2.82% for the first quarter of 2023, is a far cry from the 10.56% increase in Q1 2023, 17.19% in Q4 2022, and 24.12% in Q3 2022 that predated it.

After years of consistently high growth, Hungary's real estate market, as the average home price increase of 2.82% for the first quarter of 2023, is a far cry from the 10.56% increase in Q1 2023, 17.19% in Q4 2022, and 24.12% in Q3 2022 that predated it.