There are no taxes on capital gains, dividends, inheritance, wealth.

Personal income tax operates on a progressive tax scale, which means that it depends on the amount of money a person earns. Progressive tax is from 10% to 30%. It starts for individuals who earn more than $18,400 in a year.

Companies pay corporate tax, that is fixed at 30%.

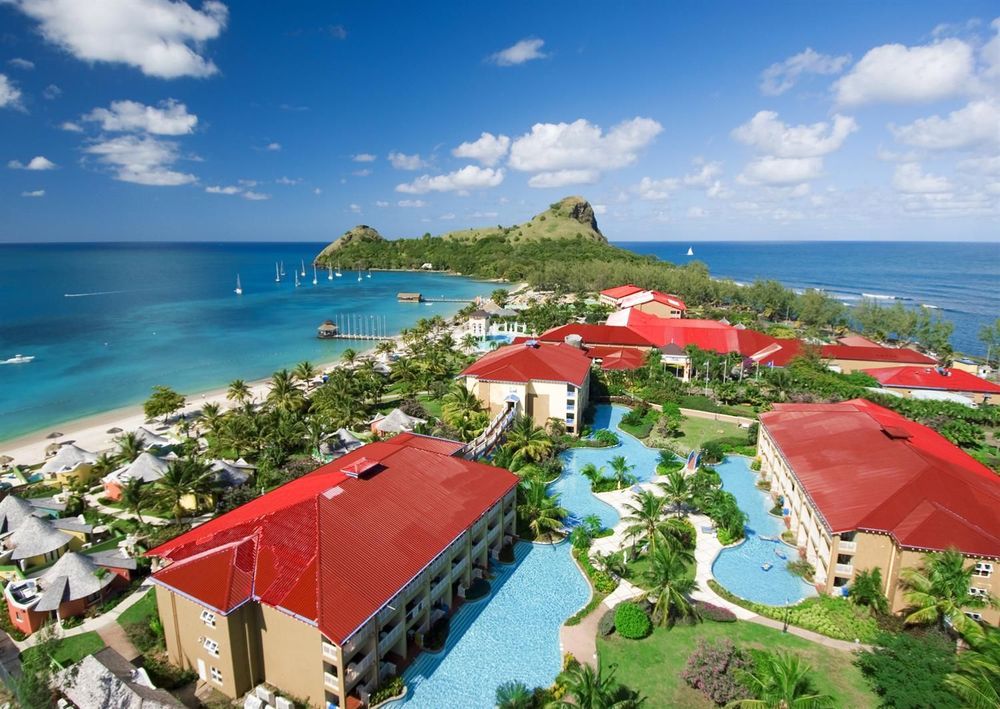

VAT (value added tax) is generally 12,5%. It is paid by the companies whose sales turnover exceed EC$400,000 per year. Some companies are exempt from paying it. Hotels pay 8%. A reduced rate of 7% applies in the hospitality industry.

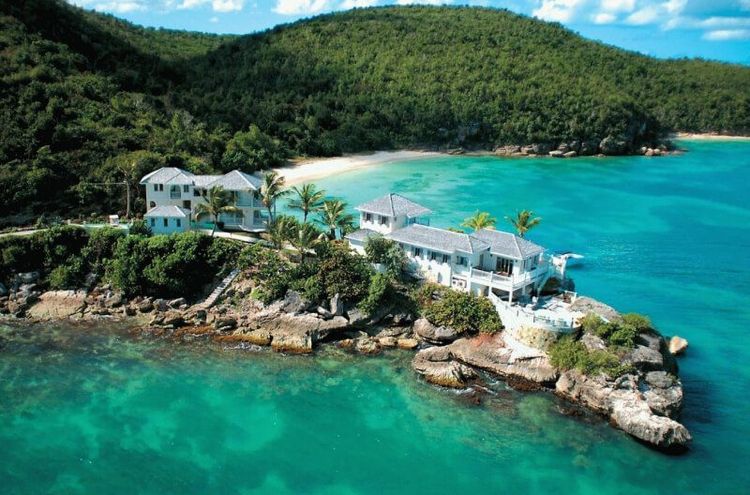

Residential properties face 0,25% tax, while commercial properties are subject to 0,4% property tax.

Sellers pay up to 5% of the property value, while the real estate purchase tax rates up to 2%.

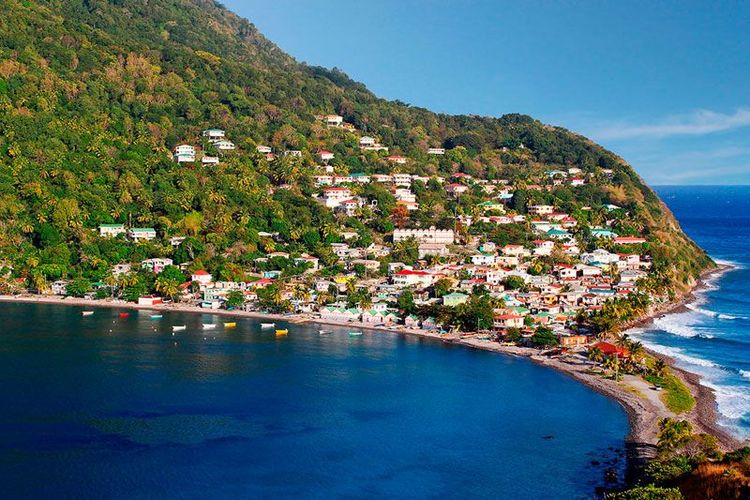

Saint Lucia has 11 Double Tax Treaties (DTC) with the following jurisdictions: Antigua and Barbuda, Barbados, Belize, Dominica, Grenada, Guyana, Jamaica, Montserrat, Saint Kitts and Nevis, Saint Vincent and the Grenadines, Switzerland, Trinidad and Tobago.