Oman, located on the southeastern coast of the Arabian Peninsula, is a country that stands out for its rich cultural heritage and stunning natural landscapes. Bordered by Saudi Arabia to the west, the United Arab Emirates to the northwest, and Yemen to the southwest, Oman enjoys a strategic position along the Arabian Sea and the Gulf of Oman, making it a key player in regional trade and commerce.

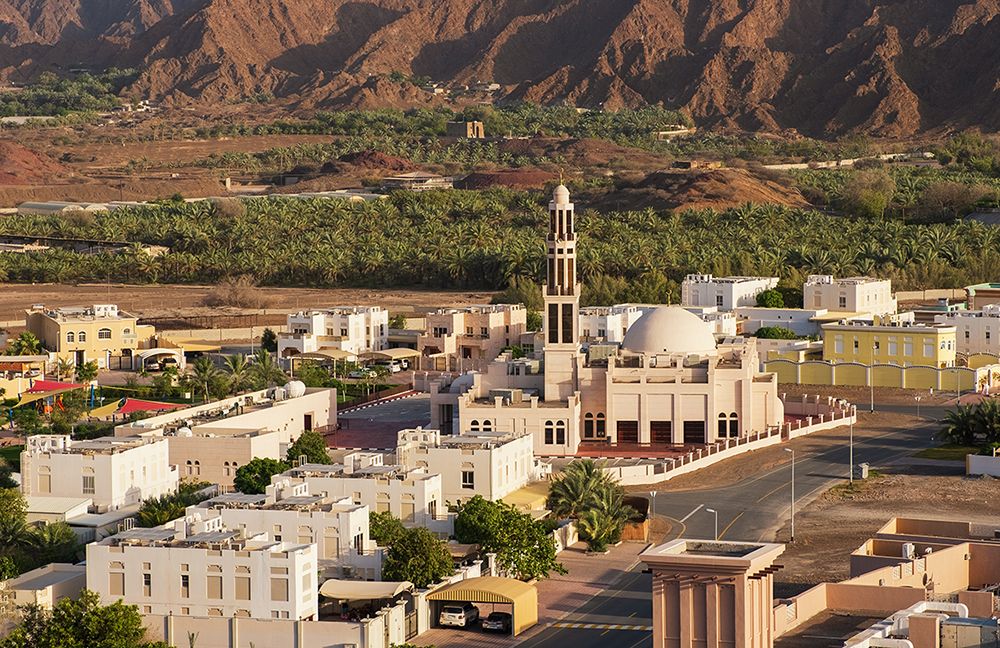

The country is known for its breathtaking scenery, which includes everything from vast deserts to towering mountains, lush green valleys, and pristine beaches. The diversity of its terrain is matched by the warmth and hospitality of its people, who are deeply rooted in a culture of generosity and respect for tradition. Oman's cities, such as the capital Muscat, blend modernity with history, offering a unique experience where one can explore ancient forts and bustling souks while also enjoying contemporary amenities and infrastructure.

Oman's economy has traditionally been fueled by its oil reserves, but the country has made significant strides in diversifying its economy, focusing on sectors such as tourism, logistics, and manufacturing. The government’s Vision 2040 initiative is a forward-looking plan aimed at sustainable development, ensuring that Oman remains a vibrant and prosperous nation in the years to come.

The national currency, the Omani Rial (OMR), is one of the strongest currencies in the world, reflecting the country's economic stability and prudent fiscal policies. The Omani Rial is divided into 1,000 baisa and is known for its high value, making it a symbol of the country’s financial strength.

Real Estate Prices

In Muscat, the capital city, the cost of real estate can vary widely based on the location and type of property:

- Luxury villas in prime areas like Shatti Al Qurum or Al Mouj can range from OMR 300,000 to over OMR 1 million depending on size, location, and amenities.

- Apartments in desirable locations within Muscat, such as Qurum or Al Khuwair, generally range from OMR 50,000 to OMR 200,000. Prices for high-end apartments in ITCs like Al Mouj can go higher, reaching OMR 300,000 or more.

- Townhouses in integrated communities such as Al Mouj or Muscat Hills are priced between OMR 150,000 and OMR 400,000, depending on the exact location and size.

- In smaller cities or suburban areas around Muscat, property prices are lower:

- Villas in these areas might range from OMR 150,000 to OMR 300,000.

- Apartments can be found in the range of OMR 30,000 to OMR 100,000, offering more affordable options compared to the capital.

Please note that these are general estimates, and actual prices may vary based on market conditions, the specific characteristics of the property, and negotiations. If you're considering investing in Omani real estate, it's advisable to consult with local real estate agents or professionals to get the most accurate and up-to-date pricing information.