Get one step closer to the business and real estate market in Eurasia, which is full of entrepreneurial opportunities and innovative ideas. Turkiye has borders with a great range of countries, thus, suggesting new opportunities to people for efficient entrepreneurship and business development.

Turkiye is actively developing the real estate segment. The most popular destinations include Istanbul, Antalya, Alanya, Bodrum, Dalaman, Izmir, Ankara, Mersin, and others.

The number of investors coming to buy property in Turkiye is rising steadily despite the fact that at the beginning of 2022 prices in the real estate market increased by 40%, and this tendency continues. Nevertheless, further development and growth of real estate market are forecast in 2024. As the government is actively investing budgets in infrastructure, transport, and materials to guarantee that housing meets all standards and high customer requirements, the increase in the value of real estate and the development of various regions are predicted. In addition to residential real estate, investors are interested in commercial real estate and land purchases.

Real Estate Prices

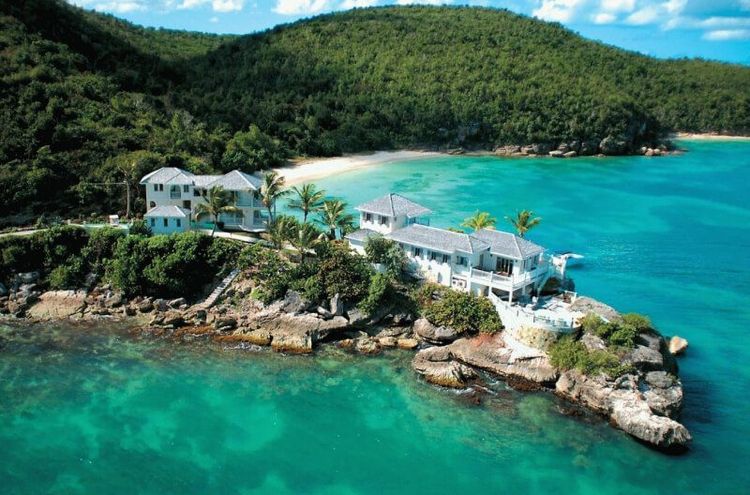

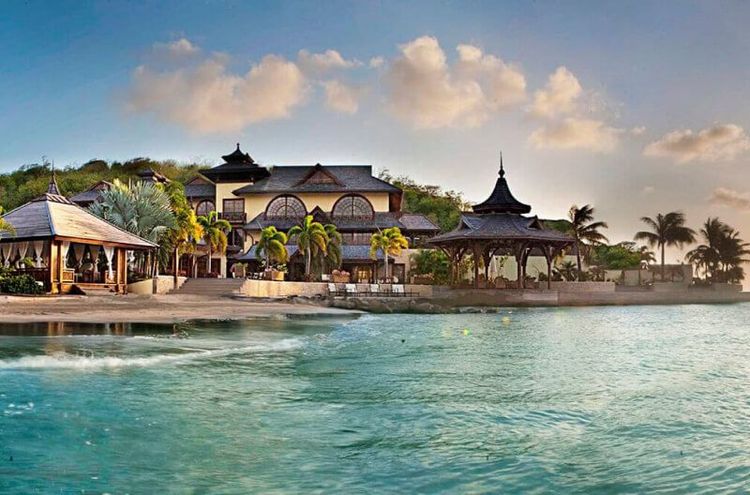

Real estate prices in Turkey attract the attention of foreign investors due to their diversity and relative affordability compared to other European countries. Turkey offers a wide range of options, from modern apartments in major cities to villas on the Mediterranean or Aegean coasts.

- Major Cities: In cities like Istanbul, Ankara, and Izmir, real estate prices vary significantly depending on the neighborhood. In central Istanbul, the cost of an apartment can start at $150,000 and reach several million dollars for luxury properties. In less prestigious areas, prices can start at $70,000.

- Resort Regions: In popular tourist areas such as Antalya, Alanya, and Bodrum, apartments can be found starting at $80,000. Villas with sea views in these regions may cost $250,000 and above.

- Less Popular Regions: In smaller towns and villages, especially those away from the coast, real estate prices are significantly lower. Here, you can purchase a house or an apartment for $50,000 or even less.

Turkey is one of the few countries offering a citizenship-by-investment program through real estate. The minimum threshold for investors is $400,000. This amount must be invested in one or more properties, and the investor must hold the property for at least three years.

The real estate market in Turkey continues to grow due to strong demand from foreign buyers, particularly from the Middle East and Europe. Given Turkey’s geographical location, developed infrastructure, and rich culture, experts predict further price increases in the coming years.

Additionally, Turkey offers favorable tax conditions for foreign investors and the option to rent out properties, making investment in Turkish real estate even more attractive.

Who Can Obtain Citizenship

In addition to the primary applicant (investor), the following categories of individuals can obtain Turkish citizenship through the investment program:

- The spouse of the primary applicant.

- Children under the age of 18. It is important that the children are not married and are financially dependent on the primary applicant.

- Parents are not included in the program based on investment and therefore cannot obtain Turkish citizenship through the primary applicant’s investment program.

All applicants undergo a due diligence process and must meet the program's requirements.