Saint Lucia citizenship by investment

Saint Lucia citizenship program

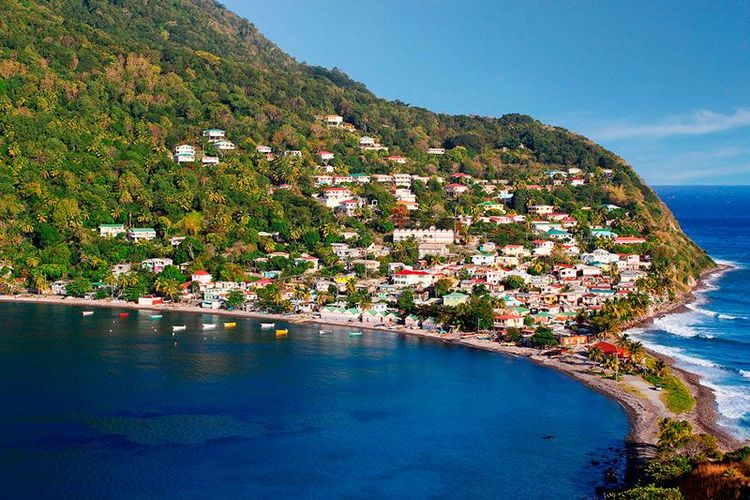

Saint Lucia is an island which is situated in the Eastern Caribbean. The political system of Saint Lucia is hugely based on the British Model, because formerly it was the colony of Great Britain till 1979 – now a member of the Commonwealth. The country has diplomatic relations and active trade with the UK and the USA. The Saint Lucian economy is primarily based on tourism and agriculture. Tourism and offshore bring 65% of its revenue.

Saint Lucia is a member of Commonwealth community, which allows free access to UK market and free travel within the Schengen zone. Also, Saint Lucia has membership in the Caribbean Community (CARICOM), and the Organization of Eastern Caribbean States (OECS).

Saint Lucia is characterized by a mix of international and domestic banks. The banking system is subject to the Eastern Caribbean Central Bank (ECCB) with the official currency of the Eastern Caribbean Dollar (XCD). Also, Saint Lucia possesses offshore banking jurisdiction. The crucial feature of offshore banking in Saint Lucia is data protecting and confidentiality it provides.

Thus, Saint Lucia possesses offshore sector, that offers a range of investment opportunities, including banking and finance, international trade, tourism and hospitality, real estate development, etc. The International Business Companies (IBC) Act provides numerous advantages for offshore companies. Saint Lucia protects its corporate sector and business environment, so that investors can enjoy security and be sure their data will remain anonymous.

Real Estate Prices in Saint Lucia

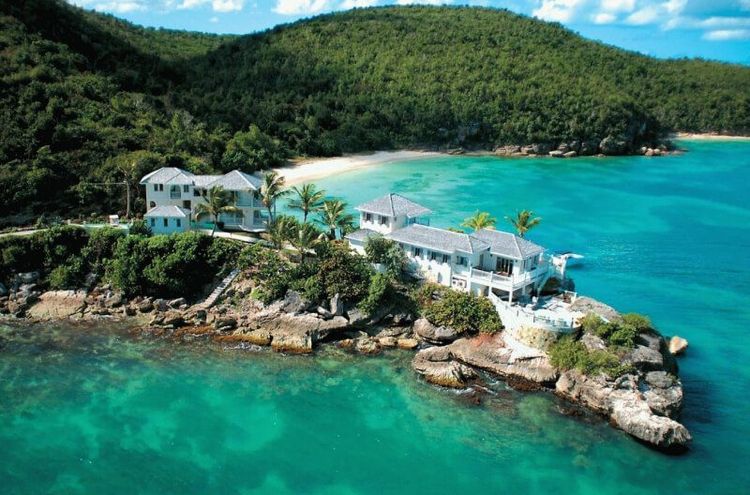

- Apartments and Condominiums: In the capital, Castries, and its surroundings, apartments and condominiums can be found starting at $200,000. These properties are often located in gated communities with access to pools, fitness centers, and other amenities.

- Houses and Villas: Prices for houses and villas vary depending on their location and ocean views. Villas with panoramic views of the Caribbean Sea can range from $500,000 to several million dollars, especially in prestigious areas like Marigot Bay or Soufrière.

- Land Plots: For those who wish to build their dream home, a wide selection of land plots is available. Land prices can start at $100,000 in less developed areas and reach several hundred thousand dollars for plots with ocean views in prime locations.

The real estate market in Saint Lucia is steadily growing, driven by interest from foreign buyers, especially those seeking citizenship through investment. Property prices are expected to rise as demand increases and infrastructure on the island improves.

Additionally, Saint Lucia offers attractive tax conditions for foreign investors, including no capital gains tax and low rental income tax rates, making real estate investment on the island even more advantageous.

Who Can Obtain Citizenship

In addition to the primary applicant (investor), the following categories of individuals can obtain Saint Lucian citizenship through the investment program:

- The spouse of the primary applicant.

- Children under the age of 30, provided they are financially dependent on the primary applicant and are not married.

- Parents and grandparents over the age of 55 who are financially dependent on the primary applicant.

- Siblings under the age of 18, provided they are unmarried, have no children, and are financially dependent on the primary applicant.

All applicants must meet the program’s requirements and undergo a due diligence process.

What does a Saint Lucia passport give you?

Saint Lucia passport visa-free countries

Tax Rates

There are no taxes on capital gains, dividends, inheritance, wealth.

Personal income tax operates on a progressive tax scale, which means that it depends on the amount of money a person earns. Progressive tax is from 10% to 30%. It starts for individuals who earn more than $18,400 in a year.

Companies pay corporate tax, that is fixed at 30%.

VAT (value added tax) is generally 12,5%. It is paid by the companies whose sales turnover exceed EC$400,000 per year. Some companies are exempt from paying it. Hotels pay 8%. A reduced rate of 7% applies in the hospitality industry.

Residential properties face 0,25% tax, while commercial properties are subject to 0,4% property tax.

Sellers pay up to 5% of the property value, while the real estate purchase tax rates up to 2%.

Saint Lucia has 11 Double Tax Treaties (DTC) with the following jurisdictions: Antigua and Barbuda, Barbados, Belize, Dominica, Grenada, Guyana, Jamaica, Montserrat, Saint Kitts and Nevis, Saint Vincent and the Grenadines, Switzerland, Trinidad and Tobago.

Business set up

Law in Saint Lucia is based on English common law, civil law and civil process follow French law traditions.

Talking upon types of entities in Saint Lucia, there are sole trader, partnership, private limited company, branch.

The most frequent type is an International Business Company (IBC).

What is attractive, there is no specific requirement for the amount of capital. Normally, it is considered to be enough to invest USD 50,000.

It usually costs around USD 1,500 for registration.

Banking system in Saint Lucia

There are 34 national and international banks in Saint Lucia. It is possible to open a bank account in person, by mail or online. All that is needed is to gather relevant documents and file an application to the bank. Pass Due Diligence, and when accepted, the client will be asked to transfer money to the account to activate it.

Investment options for Saint Lucia citizenship

Post-immigration services

Proof of address (Lease Agreement + Utility bill)

Banking assistance (local and offshore accounts)

Tax Identification Number

Getting a driver's license

Police reports for approved clients

Company registration/incorporation (local and offshore companies)

Requirements for applicants

- Main applicant

- Spouse

- Children below 30 years old (single and childless)

• Parents of MA and spouse above 55 years old - Unmarried siblings below 18 years old, provided they have received the consent of their parents or guardians.

Our successful cases

Testimonials from satisfied clients

I thank One World Migration for the opportunity to move to Turkey with their help. I looked to relocate my company to be closer to my European partners and suppliers from the Middle East.

I first came to Portugal as a tourist 3 years ago. Having assessed the situation and got acquainted with this country, I decided that I wanted to stay here to live. Thanks to the efforts of One World Migration, this became possible.

The decisive factor for me in my decision to obtain Grenadian citizenship was the possibility of a visa-free visit to Europe, where my husband and I love to come both on business trips and on vacation. Thank you One World Migration!

I have to thank One World Migration and their customer mindset for obtaining Grenadian citizenship. We were able to prepare all the necessary documents in the shortest possible time and without unnecessary worries and they accompanied us throughout the entire process.

Frequently Asked Questions

Adopted kids, kids from another marriage are accepted. Documents of adoption, agreement from wife, dependent parents 56 years and above, Children till 26 years (married/unmarried), children up to 30 years old can be included.

Choose the option that suits you

Similar programs

Blog

Given current geopolitical dynamics, Russia is emerging as a promising land of new opportunities and a lifestyle substantiating traditional values.

The Gulf Cooperation Council (GCC) is emerging as a hotspot for investment migration, with countries like Saudi Arabia, the United Arab Emirates, Oman, and Qatar leading the charge.

EU citizenship is one of the most valuable global mobility assets the world has to offer. It opens the door to not just one, but 27 countries that offer a high standard of living, robust economies, excellent healthcare systems, and political stability.