The Council of Home Affairs Ministers of the European Union has approved a new timetable for the implementation of the European Travel Information and Authorization System (ETIAS).

Grenada is an excellent choice for business and investment in the Caribbean. Opening a bank account in Grenada is a simple process if you know the basics.

Choose a bank that best suits your needs and has a good reputation in the banking industry. There are several international banks operating in Grenada, such as Republic Bank Grenada Limited, Scotiabank Grenada and others.

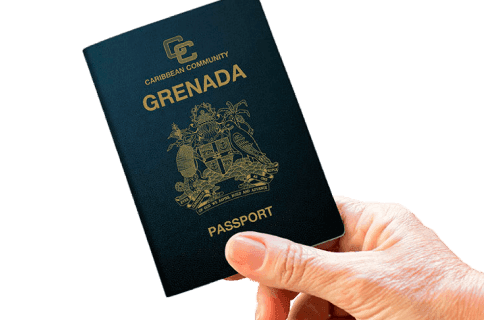

Individuals need a passport, proof of address (such as a utility bill) and proof of income (such as a tax return or bank statement from another country).

Legal entities need proof of company existence, documents confirming the composition of directors and shareholders, documents disclosing a company's beneficiary, and a power of attorney for the account manager.

Fill in a bank account application form and state what services you need.

The bank will assess your documents and completed application, which can take up to several weeks.

If your application is approved, the bank will notify you that you can open your own bank account. You may need additional documents to complete the account opening process.

Opening a bank account in Grenada is a simple and efficient way to manage your finances in the Caribbean. Low currency risks and the availability of international banks make Grenada an attractive place to open an account for businesses and investors.

One World Migration's team of experts can help you with opening a bank account to make the process as quick and simple as possible.

The Council of Home Affairs Ministers of the European Union has approved a new timetable for the implementation of the European Travel Information and Authorization System (ETIAS).

From May 1, 2025, all Vanuatu passport applicants are required to undergo biometric data collection.

On March 12, 2025, the Vanuatu Commission for Citizenship by Investment Program (CIIP) at its first meeting decided to temporarily suspend the acceptance of new applications for citizenship through Coffee Fund investments until further notice.